Table of Content

Introduction

Before you learn about making a financial plan, you should know the difference between financial statements* and a financial plan*. A financial statement can be defined as the formal record of all the financial activities being done by a company. Combining these financial statements would give you the present landscape of the business and also help predict what should be planned for the future of the company.

If you are an entrepreneur and have just launched your business, which is in its early stages, making financial statements would be like your daily bookkeeping. When you have the data and organize it into records, you would be creating financial statements for your company. Financial statements are extremely important records for any business as they are crucial when you want to find an investor or need bank loans.

From all the data present in your financial statements, you would have to create a financial plan for your business. It is important to have a comprehensive financial plan to achieve the financial goals for your company, make a profit, and pay your bills. Below is a step-by-step guide for entrepreneurs on creating a financial plan.

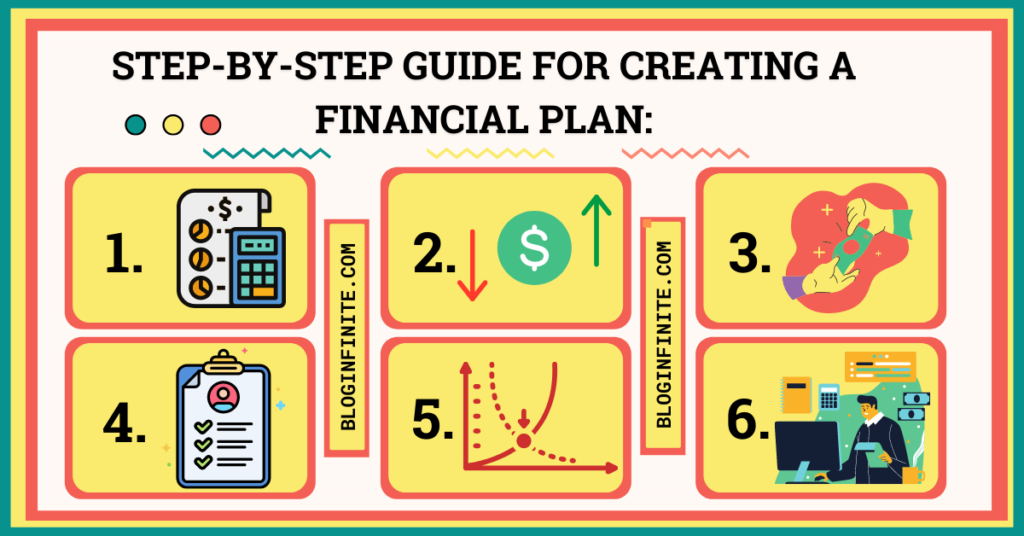

Step-by-Step Guide for Creating a Financial Plan:

Before starting your own company, the first thing to consider is how much funds you will need. You would need to research and make a list of everything that you would need to set up your business. Making a list of the items that you will need would also help you predict the number of funds that would be required and thus, you will be able to think beforehand how you would acquire the amount. Here are the costs that you generally have to bear when you start a company.

- Utilities, equipment, and rent

- Working capital* at the beginning

- Licenses and registrations to register the name of your business and other requirements

2. Predict loss and profit:

You would have to make a note of all your expenses and sales every month and also on a quarterly and yearly basis. By keeping a record of these, you would be able to work out the profit and loss that your company makes during these periods. With this data reading available, you would also be able to set targets for sales, pricing for your products and services, and also predict profit margins. Research about how other businesses in your niche are performing and conduct industry analysis*.

3. Calculate and project your cash flow:

Even if your company makes a profit, you may find yourself running out of cash. Thus, you would need to work out the details of when you receive the payment for your services and project your cash flow in different areas of your business. You must project the cash flow for your company at least a year ahead so that you can solve any ambiguities. You must have proper strategies to manage the cash flow as well.

4. Tally your balance sheet:

To make a proper financial plan for your company, you would need to list all the liabilities and assets for your business in the initial 12 months. That would be a proper record to have about the finances of your business. That would also help you gauge if you have enough money for the proper running of your business daily. Your balance sheet must have three things- Liabilities*, Assets*, and Owner’s equity*.

To determine the number of sales you need to cover your company’s costs; you would need to conduct a break-even analysis. When your company earns more than the break-even point, you can consider it a profit. When you find the break-even point, you will be able to determine the pricing, costs and analyze sales. This would thus help you decide whether your business would be a success. Here’s what you need to do to calculate your break-even point-

- Estimate realistic sales. If you have a company that provides services, estimate you won’t be paid for all of the time you provide but only for 60-70% of it

- Change your sales, costs, and prices and try different scenarios to find the most feasible break-even point

- When you make predictions, note down the reasons too as you may be asked for those if you need to borrow funds

6. Get help:

If you think you would be unable to properly work out a financial plan, you could always seek professional help. Hiring an accountant* who can help figure out your company finances is a great idea. They would also be able to tell you the potential of your business based on the numbers and records.

Final Thoughts:

Making a financial plan for your business can be pretty intimidating initially. But it is also extremely important if you want to see your business succeed. As mentioned before, if you don’t feel up to the task, you can always ask for professional help.

Footnotes (*)

Financial statement– A formal record of the financial activities of a business, entity, or person

Financial plan– It is a document containing the data about the financial goals of a company and the strategy for achieving those

Upfront cost– The cost required to start a business or owed in a venture initially

Capital– Capital generally refers to liquid assets or cash that is available for spending on daily activities of a business

Industry analysis– An analysis to determine a company’s position concerning others in the same niche, offering similar products and services

Liabilities– Generally a sum of money that a company or a person owes

Assets– An entity that benefits its economic owner over the period that the person holds it for

Owner’s equity– An amount of money that would go to the shareholders of a company if the company’s assets were liquidated

Breakeven point– The level at which the revenues earned from a product equals the cost of its production

Accountant– A person responsible for making and interpreting financial records of a person, company, or entity

If you have any queries regarding this blog you can comment down below and also can contact us on our contact page. If you Want to write for us you can apply for it at Write For Us.

Trackbacks/Pingbacks